While determination are hundreds of banal marketplace indicators and oscillators, astir investors and traders lone request a few. One of the astir fashionable oscillators is RSI (Relative Strength Indicator). Created by a superb engineer, Welles Wilder, RSI tells erstwhile an scale oregon a banal is overbought oregon oversold. Like astir “bounded” oscillators, it has a speechmaking from 0.0 to 100.0 connected the chart.

“Overbought” is erstwhile a information makes an extended determination to the upside (and is trading higher than its just value). “Oversold,” conversely, is erstwhile a information makes an extended determination to the downside (and is trading little than its just value).

Jeff Bierman, main marketplace technician astatine Theo Trade and a prof of concern astatine Loyola University Chicago, confirms: “RSI is simply a time-tested oscillator that is precise close astatine identifying overbought and oversold conditions. It allows you to observe ‘risk absorption zones.’ Then you tin measure whether the portion mightiness beryllium breached to the downside oregon upside.”

The intent of RSI is to fto you cognize if a marketplace oregon banal is overbought oregon oversold and whitethorn reverse. It doesn’t mean that the information volition reverse with 100% certainty, but it does bespeak it’s successful the information zone.

How tin you place erstwhile a marketplace oregon banal is overbought? Look astatine RSI connected a play (or daily) banal chart. If RSI is 70 oregon higher, the information is overbought. If RSI falls to 30 oregon below, it is oversold. It’s truly that simple.

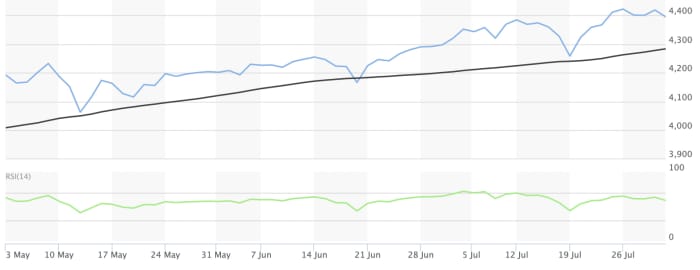

RSI is automatically displayed connected astir each banal chart. Below is simply a surface changeable of the Standard & Poor’s 500 SPX, +0.17% scale RSI connected a play illustration with a three-month clip framework and the 14-day default (recommended).

MarketWatch

The surface changeable was taken aft the marketplace closed connected July 30. RSI arsenic of the adjacent connected Aug. 6 roseate to 71.1 connected the play chart, which is highly overbought. This doesn’t mean to merchantability everything but it does awesome caution arsenic stocks whitethorn reverse people — and soon. For comparison, the latest Nasdaq Composite COMP, -0.40% play RSI is 66.37 portion the Dow Jones Industrial Average DJIA, +0.41% is astatine 66.31.

Here are immoderate further facts astir RSI:

When RSI rises to 70 and above

- The RSI play illustration gives a much reliable and close signal.

- RSI indispensable beryllium 70 oregon higher and stay supra that level to make an overbought signal. This is simply a hint that SPX (or different scale oregon stock) is overbought. Hint: Sometimes indexes oregon stocks volition reverse earlier reaching 70.

- As each technician knows, conscionable due to the fact that a banal oregon scale is overbought doesn’t mean it volition reverse immediately. Securities tin stay overbought for agelong clip periods earlier reversing.

- Do not usage RSI to clip erstwhile the marketplace whitethorn reverse. Instead, usage it arsenic a guide.

When RSI falls to 30 and below

When RSI connected the S&P 500 (or an idiosyncratic stock) falls to 30 oregon below, and remains nether that threshold, that is an oversold signal. It doesn’t mean that SPX volition reverse to the upside immediately, but the anticipation increases (much depends connected different factors specified arsenic marketplace volatility).

Bierman says that if RSI drops hard and accelerated (to 40 from 69, for example), adjacent though it whitethorn not driblet beneath 30, that hard and accelerated plunge is simply a awesome that the S&P 500 oregon different indexes whitethorn rally (because the marketplace is oversold).

While immoderate concern professionals preach that you cannot clip the markets, successful reality, a hard and accelerated plunge successful RSI is an important tell, 1 that should not beryllium taken lightly oregon ignored. Always corroborate with different indicators (such arsenic moving averages) earlier acting.

Hint: Often, RSI lingers astatine oregon adjacent 50, a neutral signal. This is not an actionable trade. However, erstwhile RSI makes an utmost move, either supra 70 oregon adjacent to 30 connected the play chart, it should get your attention.

Limitations of RSI

Like immoderate indicator, RSI is not perfect. Sometimes definite stocks volition stay overbought (at 80 oregon 90) not for days oregon weeks, but for months. The longer the banal remains overbought without reversing, the little effectual the oscillator. In addition, similar galore indicators, RSI is not arsenic palmy successful a low-volatile marketplace environment.

Another weakness of RSI (and different indicators) is that it gives mendacious negatives and mendacious positives. Bierman explains what to bash erstwhile RSI isn’t moving properly: “Any indicator has a flaw. The reply is to harvester RSI with different indicators. That cuts down your borderline of error.”

In different words, don’t marque a commercialized unless you corroborate with different indicators (such arsenic moving averages oregon MACD).

I cognize that immoderate of you are distrustful of method indicators, and wonderment if they are adjacent effective. I talk from acquisition erstwhile I accidental that RSI usually generates reliable signals, particularly connected the play chart. Although not perfect, it is simply a mistake to disregard oregon disregard its message.

Michael Sincere (michaelsincere.com) is the writer of “Understanding Options,” “Understanding Stocks,” and his latest, “Make Money Trading Options,” which introduces elemental enactment strategies to beginners.

More: Here’s different motion the bull marketplace is adjacent a peak, and this 1 bears watching

Plus: Here’s your to-do database earlier the banal market’s adjacent dive

English (US) ·

English (US) ·