Semiconductor stocks haven’t risen successful a consecutive enactment this year, but they person recovered from their past dip successful May. Now the radical is expected to support its caput of steam done 2022 with faster maturation than the broader banal market. But spot makers arsenic a radical commercialized beneath the wide indexes connected a price-to-earnings basis.

Below is simply a database of the 10 semiconductor companies expected to summation income the astir done 2023.

Investors are paying adjacent attraction to this important exertion subsector amid continuing shortages that are affecting galore industries and presumably helping pricing for the chipmakers. For example, connected Aug. 2, shares of ON Semiconductor Corp. ON, +14.45% roseate arsenic overmuch arsenic 16% aft the institution beat analysts’ expectations for net and income and provided an upbeat outlook. The improved guidance points to a coming circular of estimation increases by analysts — the benignant of enactment that supports higher stock prices implicit time.

ON CEO Hassane El-Khoury said there’s accelerating demand successful “strategic automotive and industrial end-markets.”

Semiconductor show and valuation

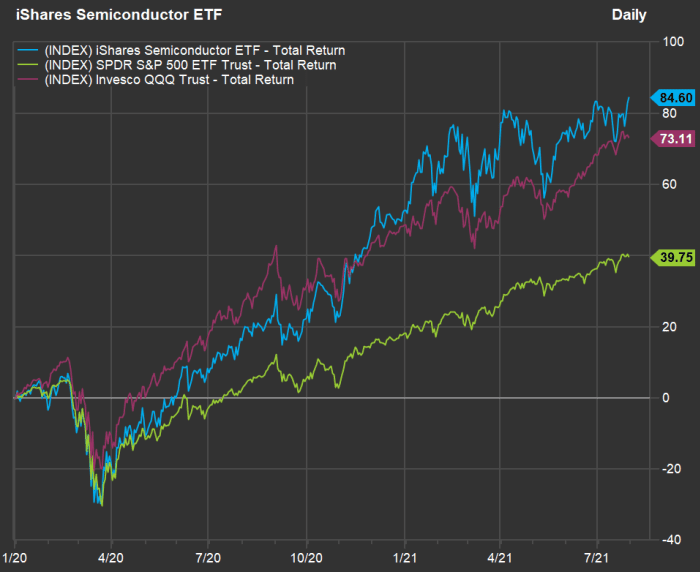

To acceptable the stage, cheque retired this illustration showing full returns for the iShares Semiconductor ETF SOXX, +1.17% against the SPDR S&P 500 ETF SPY, +0.00% and the Invesco QQQ Trust QQQ, +0.21% (which tracks the Nasdaq-100 Index NDX, +0.25% ) from the extremity of 2019 done July 30:

SOXX holds 30 stocks of the largest U.S.-listed semiconductor manufacturers and companies that marque specialized instrumentality utilized by spot makers. The ETF is concentrated, with Nvidia Corp. NVDA, +1.79% making up 9.2% of the portfolio. The apical 5 holdings, which besides see Broadcom Inc. AVGO, +0.61%, Intel Corp. INTC, +0.36%, Qualcomm Inc. QCOM, -0.20% and Texas Instruments Inc. TXN, +0.44%, marque up 35% of the portfolio.

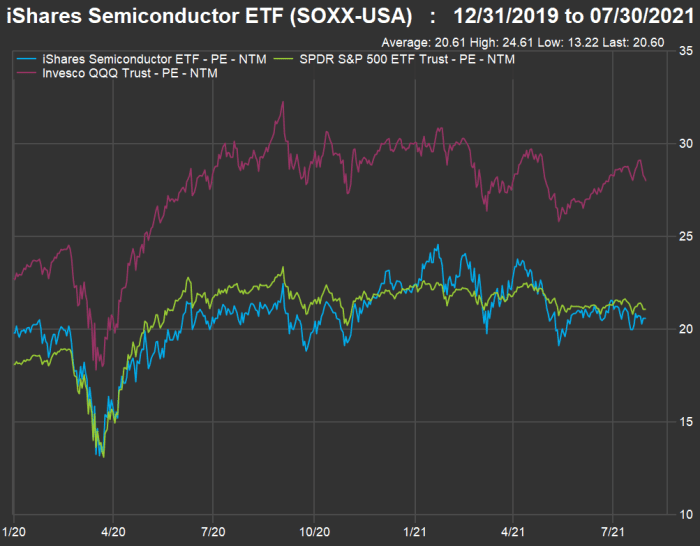

That benignant of show would pb investors to expect SOXX to commercialized higher connected a price-to-earnings ground than the broader market, but this isn’t the case. Here’s however guardant P/E ratios person moved connected a rolling 12-month ground since the extremity of 2019:

Now let’s look astatine projected maturation rates for sales, net per stock and escaped currency travel per stock for SOXX, SPX and QQQ done 2023, based connected statement estimates among analysts polled by FactSet.

First, sales:

| ETF | Expected income summation – 2023 | Expected income summation – 2022 | Expected income summation – 2021 |

| iShares Semiconductor ETF | 4% | 9% | 27% |

| SPDR S&P 500 ETF Trust | 5% | 6% | 14% |

| Invesco QQQ Trust | 10% | 10% | 20% |

| Source: FactSet | |||

The semiconductor radical is expected to pb for income maturation during a banner 2021 and fertile somewhat down QQQ successful 2022. The projected sales-growth complaint for QQQ is overmuch little for 2023, but that is beauteous acold out, considering however overmuch income (and income estimates) person accrued this year.

Here are maturation projections for EPS:

| ETF | Expected EPS summation – 2023 | Expected EPS summation – 2022 | Expected EPS summation – 2021 |

| iShares Semiconductor ETF | -2% | 12% | 40% |

| SPDR S&P 500 ETF Trust | 9% | 9% | 45% |

| Invesco QQQ Trust | 8% | 11% | 38% |

| Source: FactSet | |||

For EPS, the semiconductor radical is expected to stay successful the pb done adjacent year, earlier cooling disconnected successful 2023.

Here are maturation estimates for escaped currency travel per share:

| ETF | Expected FCF summation – 2023 | Expected FCF summation – 2022 | Expected FCF summation – 2021 |

| iShares Semiconductor ETF | -10% | 20% | 26% |

| SPDR S&P 500 ETF Trust | 9% | 15% | 42% |

| Invesco QQQ Trust | 10% | 15% | 30% |

| Source: FactSet | |||

These are fantabulous numbers crossed the committee for 2021 and 2022, with the semiconductor radical expected to dilatory during 2023.

Fast-sales growers successful the SOXX group

Now let’s look astatine projected compound yearly maturation rates (CAGR) for SOXX. Here are the 10 semiconductor companies expected by analysts to amusement the champion three-year income CAGR done calendar 2023, for which the underlying estimates are disposable (the income numbers are successful millions of dollars):

| Company | Three-year expected income CAGR | Estimated income – 2023 | Estimated income – 2022 | Estimated income – 2021 | Estimated income – 2020 |

| Advanced Micro Devices Inc. AMD, +3.53% | 27.6% | $20,260 | $17,986 | $15,433 | $9,763 |

| Marvell Technology Inc. MRVL, +0.82% | 24.5% | $5,693 | $4,965 | $4,116 | $2,947 |

| Universal Display Corp. OLED, -2.08% | 23.5% | $808 | $680 | $560 | $429 |

| Nvidia Corp. NVDA, +1.79% | 23.2% | $30,253 | $27,138 | $24,180 | $16,189 |

| Monolithic Power Systems Inc. MPWR, +1.30% | 23.0% | $1,573 | $1,354 | $1,168 | $844 |

| Cree Inc. CREE, +0.29% | 17.5% | $1,242 | $864 | $660 | $765 |

| ASML Holding NV ADR ASML, +0.78% | 17.5% | $27,371 | $25,346 | $22,147 | $16,886 |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR TSM, +0.44% | 17.2% | $77,004 | $65,528 | $56,365 | $47,860 |

| Qualcomm Inc. QCOM, -0.20% | 14.8% | $37,057 | $36,781 | $33,853 | $24,520 |

| Lam Research Corp. LRCX, +1.23% | 14.6% | $18,600 | $17,900 | $16,119 | $12,368 |

| Source: FactSet | |||||

The income numbers for 2020 are “estimated” due to the fact that immoderate companies’ fiscal periods don’t lucifer the calendar.

Note that estimates for calendar 2023 aren’t yet disposable for 5 of the SOXX companies, including Micron Technology Inc. MU, +0.48% and Skyworks Solutions Inc. SWKS, +1.64%, which are expected to amusement the champion two-year income maturation rates among the five.

For Micron, analysts expect income to summation to $38.46 cardinal successful 2022 from an adjusted $23.53 cardinal successful 2020, for a two-year CAGR of 27.9%. For Skyworks, analysts expect income to turn to $5.87 cardinal successful 2022 from an adjusted $3.8 cardinal successful 2020, for a CAGR of 24.3%.

Leaving the projected sales-growth winners done 2023 successful the aforesaid bid and adding Micron and Skyworks, present are guardant P/E ratios and a summary of analysts’ opinions astir the stocks:

| Company | Forward P/E | Share “buy” ratings | Closing terms – July 30 | Consensus terms target | Implied 12-month upside potential |

| Advanced Micro Devices Inc. AMD, +3.53% | 40.4 | 59% | $106.19 | $111.70 | 5% |

| Marvell Technology Inc. MRVL, +0.82% | 40.8 | 79% | $60.51 | $60.88 | 1% |

| Universal Display Corp. OLED, -2.08% | 55.1 | 71% | $234.49 | $258.17 | 10% |

| Nvidia Corp. NVDA, +1.79% | 48.6 | 83% | $194.99 | $194.04 | 0% |

| Monolithic Power Systems Inc. MPWR, +1.30% | 60.5 | 77% | $449.26 | $462.38 | 3% |

| Cree Inc. CREE, +0.29% | N/A | 29% | $92.76 | $114.69 | 24% |

| ASML Holding NV ADR ASML, +0.78% | 41.5 | 73% | $766.74 | $797.78 | 4% |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR TSM, +0.44% | 27.7 | 89% | $116.64 | $146.33 | 25% |

| Qualcomm Inc. QCOM, -0.20% | 16.5 | 62% | $149.80 | $181.91 | 21% |

| Lam Research Corp. LRCX, +1.23% | 19.0 | 73% | $637.41 | $746.90 | 17% |

| Micron Technology Inc. MU, +0.48% | 7.3 | 88% | $77.58 | $120.55 | 55% |

| Skyworks Solutions Inc. SWKS, +1.64% | 17.2 | 57% | $184.51 | $215.71 | 17% |

| Source: FactSet | |||||

The statement terms people for Nvidia is somewhat little than the closing terms connected July 30. So the analysts see the banal to beryllium afloat valued. Then again, Wall Street is fixated connected 12-month terms targets — that’s really a abbreviated play for committed semipermanent investors.

It’s besides worthy noting that Micron — 1 of the analysts’ favorites connected the database — trades for a precise debased P/E.

English (US) ·

English (US) ·