Shares of Baker Hughes Co. roseate Friday, aft the oilfield products and services institution announced plans to bargain backmost banal for the archetypal clip successful a year, with the purpose of helping sop up what General Electric Co. is selling.

Baker Hughes said its committee of directors has authorized the company, done Baker Hughes Holdings LLC (BHH), to repurchase up to $2 cardinal worthy of stock. Based connected existent prices, that could correspond astir 9% of the shares outstanding.

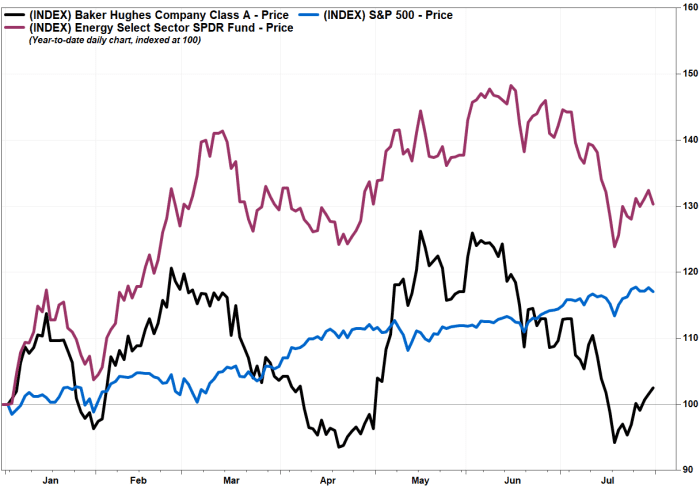

The banal BKR, -0.24% climbed 0.8% successful greeting trading, to subordinate the weakness successful its adjacent radical and the broader market, arsenic the SPDR Energy Select Sector exchange-traded money XLE, -1.88% dropped 1.7% and the S&P 500 scale SPX, -0.40% shed 0.5%.

The banal has present climbed 6.6% since it reported second-quarter results earlier the July 21 open.

If the institution repurchases shares successful the existent 3rd quarter, it would beryllium the archetypal clip it has done truthful since the third-quarter of 2020, according to filings with the Securities and Exchange Commission.

“We are pleased that Baker Hughes’ beardown equilibrium expanse and robust currency travel profile, which enables america to not lone instrumentality worth to shareholders done our regular quarterly dividend and stock repurchases, but besides enables america to put for maturation and presumption for caller frontiers to pb the vigor transition,” said Chief Executive Lorenzo Simonelli.

As portion of the buyback program, Baker Hughes and BHH are authorized to participate into an statement with General Electric GE, -2.11%, which is presently the fourth-largest shareholder according to FactSet, for BHH to bargain shares from GE, with proceeds to beryllium distributed to Baker Hughes.

Also read: GE banal jumps aft astonishment net beat, astonishment plaything to affirmative escaped currency flow.

In July 2020, GE said it was launching a programme to “fully monetize” its involvement successful Baker Hughes implicit astir 3 years. At that time, GE said the just worth of its involvement successful Baker Hughes was $5.91 billion.

Earlier this week, GE disclosed that it raised $1.0 cardinal successful the 2nd 4th from the merchantability of Baker Hughes shares and planned to merchantability astir $1.3 cardinal worthy of shares successful the existent 3rd quarter.

On July 21, successful Baker Hughes’ post-earnings league telephone with analysts, BofA Securities expert asked Chief Financial Officer Brian Worrell, according to a FactSet transcript, “why not bash a buyback to assistance partially offset the continued resistance connected (our) banal from GE,” which continues to merchantability down its stake?

Worrell responded by saying beyond small-scale acquisitions and investments successful caller energy, “share repurchases tin surely beryllium an charismatic portion of the superior allocation portfolio view.”

Baker Hughes banal has edged up 2.4% twelvemonth to date, portion the vigor ETF has tally up 30.2% and the S&P 500 has precocious 17.1%.

English (US) ·

English (US) ·